Free Online Mortgage Payment Calculator

Table of Content

This results in the borrower paying off the mortgage faster. Home insurance—an insurance policy that protects the owner from accidents that may happen to their real estate properties. Home insurance can also contain personal liability coverage, which protects against lawsuits involving injuries that occur on and off the property. The cost of home insurance varies according to factors such as location, condition of the property, and the coverage amount. The down payment is the money you pay upfront to purchase a home. The down payment plus the loan amount should add up to the cost of the home.

A long-term mortgage is a loan with a longer length of time. Long-term mortgages typically have higher rates but offer more protection against rising interest rates. Penalties for breaking a long-term mortgage can be higher for this type of term.

Monthly Pay: $2,024.72

If you have a high credit score, you can qualify for competitive rates. For buyers looking for luxury homes, private lenders offer jumbo mortgages that exceed conforming loan limits. Just like FHA loans, USDA loans require a mortgage insurance premium called a guarantee fee. It’s paid both as an upfront closing fee and as an annual guarantee fee included in your monthly payments. On average, the downpayment for conventional loans is usually 10 percent of the home’s price.

Mortgage interest rates are influenced by the market and your financial health which takes into account your credit score and the down payment amount. Taking the time to gather downpayment funds will help you save. You can reduce the VA funding fee rate by making a 5 percent downpayment. And if you aim for a 10 percent 10 downpayment, even better. However, the good news is there are other financing options out there that’s worth exploring.

Deciding how much house you can afford

When borrowers get conventional loans, they usually take 30-year fixed-rate terms. The longer term helps them afford lower monthly payments compared to 15 or 20-year loans. And once you decide on a 30-year term, it means making payments for three decades. This is a very long time, so make sure you can sustain payments even after retirement. Down payment—the upfront payment of the purchase, usually a percentage of the total price. This is the portion of the purchase price covered by the borrower.

Opportunity costs—Paying off a mortgage early may not be ideal since mortgage rates are relatively low compared to other financial rates. For example, paying off a mortgage with a 4% interest rate when a person could potentially make 10% or more by instead investing that money can be a significant opportunity cost. Property taxes—a tax that property owners pay to governing authorities.

Explore personal banking

However, it becomes more expensive the longer you pay the loan. Because of this, other borrowers choose to refinance their FHA loan into a conventional loan. This eliminates the PMI requirement and helps them secure a lower rate. In most cases, homeowners who refinance also take shorter terms. In general, a longer term duration imposes higher interest rates.

Homebuyers looking to secure a conventional loan must have a good credit score. You must save adequate funds to cover monthly mortgage payments. If your downpayment is less than 20 percent of the home’s value, you must factor in private mortgage insurance in your expenses. Conventional loans are commonly offered in 15 and 30-year fixed rate loans. But borrowers can also take 10-year, 20-year, and 25-year terms.

Treasury & payment solutions

This basically means if you pay $1,000 per month in debts and you make $2,000 per month, your back-end ratio is 50%. Most lenders suggest this ratio be less than 43% of your gross income. This equation is the simplest calculation that uses only your timeline, interest rate, and loan amount.

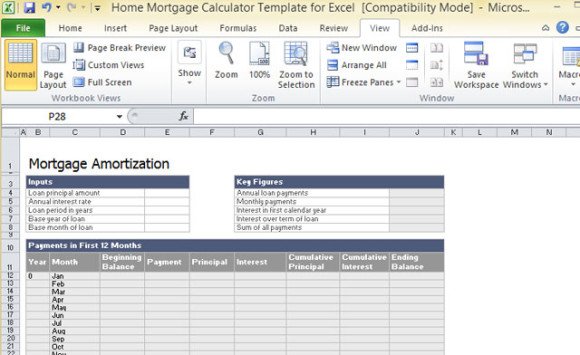

Typically, mortgage lenders want the borrower to put 20% or more as a down payment. If the borrowers make a down payment of less than 20%, they will be required to pay private mortgage insurance . Borrowers need to hold this insurance until the loan's remaining principal dropped below 80% of the home's original purchase price. A general rule-of-thumb is that the higher the down payment, the more favorable the interest rate and the more likely the loan will be approved. This calculator figures monthly mortgage payments based on the principal borrowed, the length of the loan and the annual interest rate.

In some cases, you can prepay a conventional loan up 20 percent before they charge a penalty fee. You can also wait for the penalty period to pass before making extra payments. Also called jumbo mortgages, non-conforming conventional loans exceed the conforming limits set by the FHFA. These loans surpass the financing limits followed by Freddie Mac and Fannie Mae. Jumbo mortgages are commonly obtained to purchase luxury houses in high-cost locations. These loans are provided by private lenders such as banks, credit unions, and non-bank mortgage institutions.

If you’re thinking about buying a condo or into a community with a Homeowners Association , you can add HOA fees. Interest rate—the percentage of the loan charged as a cost of borrowing. Mortgages can charge either fixed-rate mortgages or adjustable-rate mortgages . As the name implies, interest rates remain the same for the term of the FRM loan.

The total is divided by 12 months and applied to each monthly mortgage payment. If you know the specific amount of taxes, add as an annual total. Most home loans require at least 3% of the price of the home as a down payment. Some loans, like VA loans and some USDA loans allow zero down.

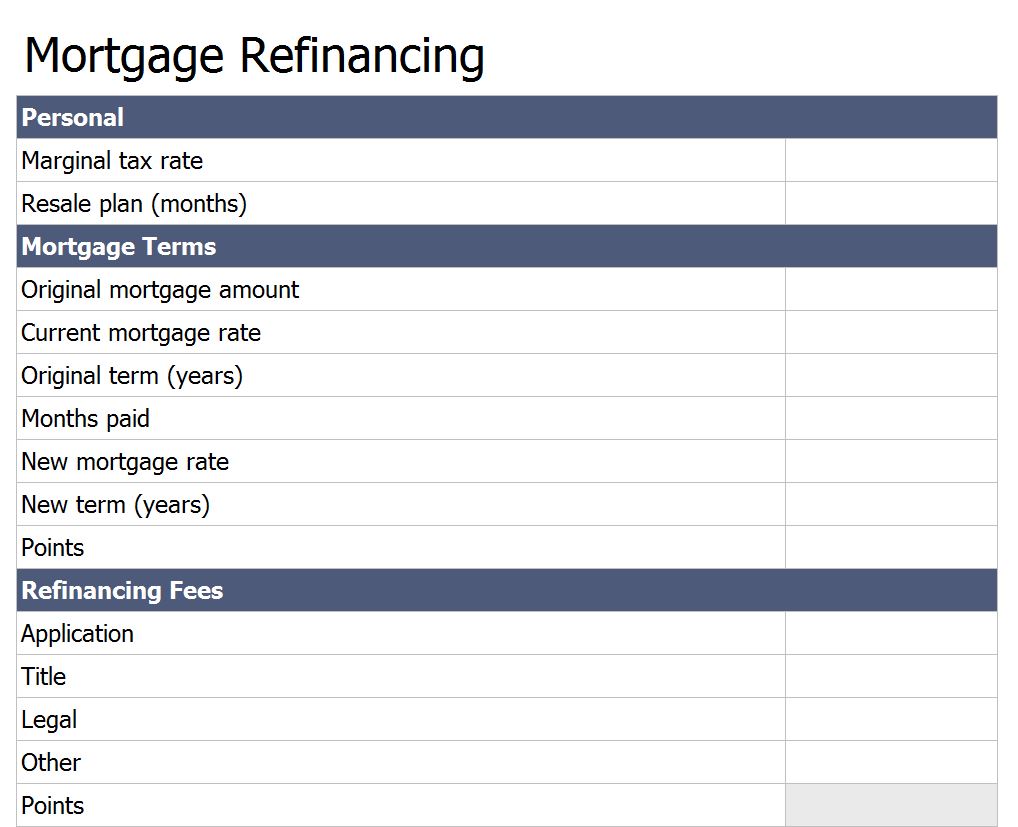

Although it's a myth that a 20% down payment is required to obtain a loan, keep in mind that the higher your down payment, the lower your monthly payment. A 20% down payment also allows you to avoid paying private mortgage insurance on your loan. The above tool estimates monthly mortgage payments with taxes, insurance, PMI, HOA fees & more. However, they will usually need to pay closing costs and fees to refinance. Borrowers should run a compressive evaluation to decide if refinancing is financially beneficial. To evaluate refinancing options, visit our Refinance Calculator.

The Complete Guide to Understanding Your Mortgage Options

Estimating PITI determines the total amount you need for monthly mortgage payments. On the other hand, if you have a low credit score with limited funds, you can check government-backed mortgages. And if you’re an active military member or veteran, you can qualify for VA loans. Government-sponsored mortgages have lower credit score requirements compared to conventional loans. However, they come with private mortgage insurance , which can make your monthly payment more costly. Now that you know your mortgage options, the next step is to stay on top of your monthly payments.

During the Great Depression, one-fourth of homeowners lost their homes. Capital locked up in the house—Money put into the house is cash that the borrower cannot spend elsewhere. This may ultimately force a borrower to take out an additional loan if an unexpected need for cash arises.

Comments

Post a Comment