How Much Mortgage Can I Borrow Free UNIFY Calculator

Table of Content

This results in the borrower paying off the mortgage faster. Home insurance—an insurance policy that protects the owner from accidents that may happen to their real estate properties. Home insurance can also contain personal liability coverage, which protects against lawsuits involving injuries that occur on and off the property. The cost of home insurance varies according to factors such as location, condition of the property, and the coverage amount. The down payment is the money you pay upfront to purchase a home. The down payment plus the loan amount should add up to the cost of the home.

The property taxes you pay help fund the services your local government provides for the community. These services include schools, libraries, roads, parks, water treatment, the police, and the fire department. Once your mortgage is paid off, you’ll still be required to pay property taxes. If you fall behind on your property taxes, you could end up losing your home to your local tax authority.

Frequently Asked Questions About Mortgages

But ideally, borrowers are encouraged to make a 20 percent downpayment to avoid the cost of private mortgage insurance. Front-end DTI – The percentage of your income that goes toward paying mortgage-related debts. It includes insurance, property taxes, monthly mortgages payments, homeowner’s association fees, etc. A longer term allows buyers to obtain a larger loan amount, which they might not afford with a shorter payment term. Meanwhile, 15-year fixed mortgages have higher monthly payments but come with lower interest rates compared to 30-year terms.

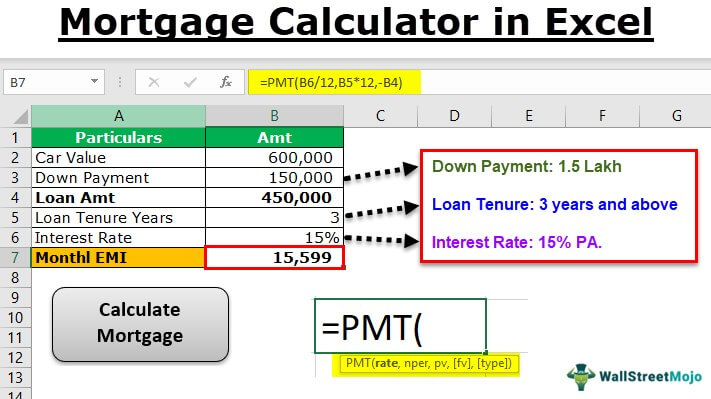

Typically, mortgage lenders want the borrower to put 20% or more as a down payment. If the borrowers make a down payment of less than 20%, they will be required to pay private mortgage insurance . Borrowers need to hold this insurance until the loan's remaining principal dropped below 80% of the home's original purchase price. A general rule-of-thumb is that the higher the down payment, the more favorable the interest rate and the more likely the loan will be approved. This calculator figures monthly mortgage payments based on the principal borrowed, the length of the loan and the annual interest rate.

Prescribed Conforming Limits

Joe's total monthly mortgage payments — including principal, interest, taxes and insurance — shouldn't exceed $1,400 per month. Lenders don't take those budget items into account when they preapprove you for a loan, so you need to factor those expenses into your housing affordability picture for yourself. Bankrate's How Much House Can I afford Calculator will help you run through the numbers. Borrowers who take conventional loans must pay private mortgage insurance if their downpayment is less than 20 percent of the home’s price.

When borrowers get conventional loans, they usually take 30-year fixed-rate terms. The longer term helps them afford lower monthly payments compared to 15 or 20-year loans. And once you decide on a 30-year term, it means making payments for three decades. This is a very long time, so make sure you can sustain payments even after retirement. Down payment—the upfront payment of the purchase, usually a percentage of the total price. This is the portion of the purchase price covered by the borrower.

Explore business banking

In the U.S., the most common mortgage loan is the conventional 30-year fixed-interest loan, which represents 70% to 90% of all mortgages. Mortgages are how most people are able to own homes in the U.S. Home loan calculator is used to calculate the monthly mortgage payments for your home. Conventional loans are backed by private lenders, like a bank, rather than the federal government and often have strict requirements around credit score and debt-to-income ratios.

This means your monthly payments will also remain the same. For example, if you took a 30-year fixed-rate loan, your payments will not change for the next 30 years. As long as you make consistent payments, your debt should be paid off within 30 years. If you want to lower your monthly payment, keep your interest rate, and avoid refinancing fees, recasting your mortgage is a good option. Fees for recasting are between $200 and $300 and includes a lump sum payment toward your principal. To reflect the new balance, your lender will then modify your amortization schedule.

If I’ve already been preapproved for a mortgage loan by Wells Fargo, how long does it typically take to close?

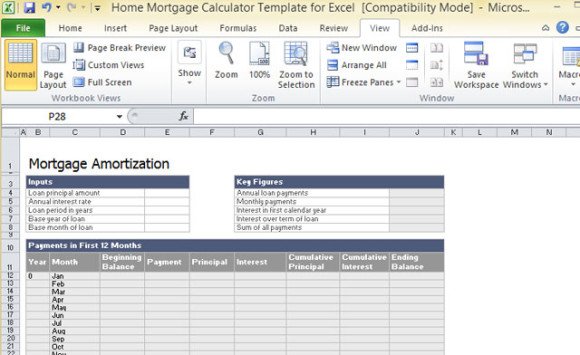

In addition to all the above options, this claculator comes with a printable loan schedule. You can leave the Loan Amount empty and fill in the payment amount you can afford to determine how much home you can afford. Escrow is a legal arrangement where a third party temporarily holds money on behalf of a buyer and seller in a real estate transaction. The calculator also allows you to easily change certain variables, like where you want to live and what type of loan you get. Plug in different numbers and scenarios, and you can see how your decisions can affect what you’ll pay for a home.

This basically means if you pay $1,000 per month in debts and you make $2,000 per month, your back-end ratio is 50%. Most lenders suggest this ratio be less than 43% of your gross income. This equation is the simplest calculation that uses only your timeline, interest rate, and loan amount.

Is there anything about calculating mortgage payments that you don't understand still? Mortgage lenders use your credit score as part of their formula to determine your level of risk. If you have a low credit score, you can expect to pay a higher interest rate. It is important to pay attention to your credit reports if you want to purchase a property. One key to sound money management is to pay off debts that contain higher interest rates first. For example, you could be paying 5% interest in mortgage debt and 18% in credit card debt.

It’s a tool to help you better understand your home financing options, whether you’re purchasing a new home or refinancing your current one. A mortgage calculator will crunch the numbers for you, including interest, fees, property tax and mortgage insurance. The results will show your approximate monthly payment and help you decide whether you can afford that home you love. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule.

Comments

Post a Comment