Mortgage Calculator Estimate Monthly Mortgage Payments

Table of Content

For your convenience current local mortgage rates are published below. PMI is automatically removed from conventional mortgages once the equity in your home reaches 22%. Alternatively, once you’ve earned at least 20% home equity, you can ask for PMI to be removed. Check your refinance options with a trusted local lender.

An ARM offers a low fixed interest rate for a set introductory period—typically 5, 7, or 10 years. Once the set introductory period ends, the interest rate adjusts . Did our mortgage calculator tell you anything interesting?

Managing Your Mortgage Payments

Short-term mortgages typically have lower interest rates. Short-term mortgages offer less protection against changing interest rates because you need to renew them more frequently. Although there is no set time frame, the custom within the real estate industry is that mortgage pre-approval is valid for between 90 to 180 days.

Extra payments are additional payments in addition to the scheduled mortgage payments. Borrowers can make these payments on a one-time basis or over a specified period, such as monthly or annually. Jumbo loans are used to secure luxury homes and houses in high-cost areas. This type of financing is appropriate for high-income buyers with exceptional credit scores of 700 and above. Some lenders may even require a minimum credit score of 720.

Want to Calculate Mortgage Payments Offline?

Choose from a variety of mortgage calculators and get a better idea of what your financial picture could be. In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term. The principal of a loan is the remaining balance of the money you borrowed. Principal does not include interest, which is the cost of the loan.

A shorter period, such as 15 or 20 years, typically includes a lower interest rate. Modify the interest rate to evaluate the impact of seemingly minor rate changes. Knowing that rates can change daily, consider the impact of waiting to improve your credit score in exchange for possibly qualifying for a lower interest rate.

Refinance to a shorter term

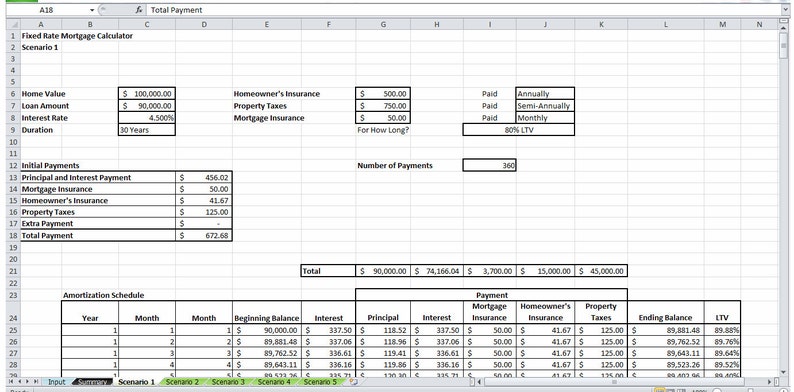

Nonetheless, our mortgage amortization calculator is specially designed for home mortgage loans. Mortgage pre-approval is a statement from a lender who’s thoroughly reviewed your finances and decided to offer you a home loan up to a certain amount. Pre-approval is a smart step to take before making an offer on a home, because it will give you a clear idea of how much money you can borrow to pay for a house. If you're spending more than you can afford.The Mortgage Calculator provides an overview of how much you can expect to pay each month, including taxes and insurance. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually. Use our affordability calculator to dig deeper into income, debts and payments. When a loan exceeds a certain amount , it's not insured by the Federal government. Loan limits change annually and are specific to the local market.

They conduct stricter investigation of creditworthiness before approving a jumbo loan. This may also include additional documentation, which takes the mortgage longer to approve. Another important lending criteria is debt-to-income ratio. DTI ratio is a percentage that compares your debts to the amount of your monthly earnings. A higher DTI ratio means your debt takes a considerable portion of your income.

Refinancing is taking a new loan to replace an existing mortgage. This allows homeowners to lower the interest rate and shorten the loan term. To qualify for refinancing, your credit score must be at least 620. Refinancing is also expensive, costing around 2%-6% of your loan. To compensate for this cost, experts traditionally advise refinancing when market rates are 2 percentage points lower. In the beginning, FHA loans are affordable for homebuyers.

FHA loans, VA loans, or any loans insured by federally chartered credit unions prohibit prepayment penalties. Total of all interest paid over the full term of the mortgage. This total interest amount assumes that there are no prepayments of principal.

Another option involves refinancing, or taking out a new mortgage to pay off an old loan. For example, a borrower holds a mortgage at a 5% interest rate with $200,000 and 20 years remaining. If this borrower can refinance to a new 20-year loan with the same principal at a 4% interest rate, the monthly payment will drop $107.95 from $1,319.91 to $1,211.96 per month. The total savings in interest will come out to $25,908.20 over the lifetime of the loan.

Comments

Post a Comment